The Founding Fathers Solve Our Debt Crisis

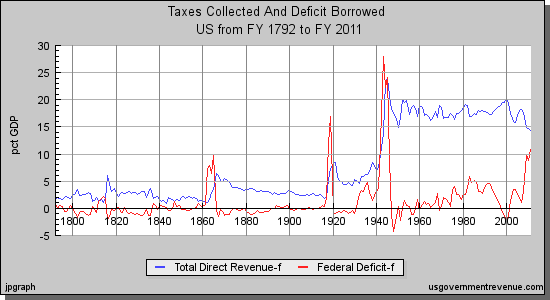

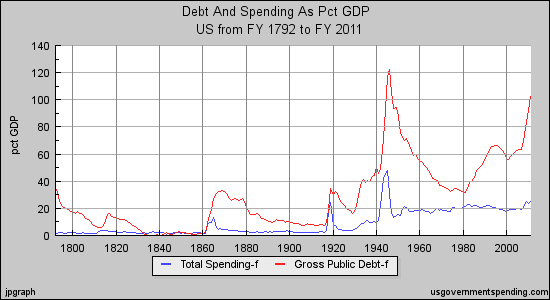

The United States accrued a huge debt to fight the American Revolution. The debt equaled 35 to 40 percent of GDP at a time when government spending and taxes were just 2 percent of GDP. Interest consumed about half of the government’s revenues. Numerous states and the government under the Articles of Confederation were negligent in paying interest and principle. The nation faced a real debt crisis.

The Founding Fathers recognized the burden of such a large debt and wanted to pay it off.

No measure can be more desirable, whether viewed with an eye to its intrinsic importance, or to the general sentiment and wish of the Nation†than to establish “a systematic and effectual arrangement for the regular redemption and discharge of the public debt. ~ George Washington

No pecuniary consideration is more urgent than the regular redemption and discharge of the public debt. ~ George Washington

I, however, place economy among the first and most important republican virtues, and public debt as the greatest of the dangers to be feared. ~ Thomas Jefferson

Many of you know that Alexander Hamilton took a different outlook. Hamilton argued:

A national debt, if it is not excessive, will be to us a national blessing.

It is a well known fact, that in countries in which the national debt is properly funded, and an object of established confidence, it answers most of the purposes of money. Transfers of stock or public debt are there equivalent to payments in specie.

Years later, Jefferson scoffed at this very notion:

At the time we were funding our national debt, we heard much about “a public debt being a public blessing;” that the stock representing it was a creation of active capital for the aliment of commerce, manufactures and agriculture. This paradox was well adapted to the minds of believers in dreams…

However, even Hamilton proposed in 1795:

Extinguishing the whole of the present debt of the United States, foreign and domestic, in a period not exceeding thirty years.

So how did the Founding Fathers pay off the debt? Did they raise taxes as some on the left currently suggest? Did they reduce spending as those on the right want?

One thing is certain: the federal government did not raise taxes to pay off the debt. In 1789, the government enacted taxes to fund the operations of government and to pay the interest on the debt. But the taxes were not high enough to pay off any debt. When the federal government assumed the state debts in 1791, a tax on spirits was raised to pay the additional interest, but not to help pay off the debt. As a result, the level of debt remained stable throughout the 1790s. However, the debt as a percentage of gross domestic product fell in half during that decade as the economy grew by leaps and bounces.

When Jefferson and the Republicans took over the reins of government in 1801, they cut spending and started paying off the debt. Half of it was paid off by 1811, but  then the debt rose even higher because of the War of 1812. After the war ended, the government started paying off the debt again and did so by the late 1830s.

Taxes were only raised in the initial period of 1789 to 1791 when the federal government was getting set up, and then to fight the War of 1812. But at no time did the federal government raise taxes to pay off its debt. Yet, the Founding Fathers all wanted to pay off the debt, but they did so by promoting economic growth through small government and keeping taxes low.

Today, we have an even greater debt problem. Nominal debt is about 80 percent of GDP and unfunded liabilities are many times greater than the official debt figure. Some are suggesting that we raise taxes to pay off the debt. Nearly all economists argue that higher taxes would reduce economic growth, making debt reduction all the more difficult. We must follow the path of the Founding Fathers. We must ensure that government spending and taxes are as low as possible and enable the economy to grow. That is the only way to restore fiscal soundness to our nation’s government.

Michael E. Newton is the author of the highly acclaimed The Path to Tyranny: A History of Free Society’s Descent into Tyranny. His newest book, Angry Mobs and Founding Fathers: The Fight for Control of the American Revolution, was released by Eleftheria Publishing in July.

The posts are coming!

The posts are coming!

6 comments

We have had a long history now of debt, we are now however nearing the cliff of economic collapse. The founders all believed the debt was bad on all levels of government and personal debt. They would certainly be pulling their hair out these days dealing with all of the big government people in Washington.

[Reply]

Michael E. Newton Reply:

July 28th, 2011 at 3:52 pm

Therein lies the difference between today and two hundred years ago. Most Founding Fathers thought debt was evil. A few, such as Robert Morris and Alexander Hamilton saw that there was some positive aspects to government debt, if and only if it were properly funded.

Today, no politician talks about the evils of debt. Instead, debt is used to buy the votes of the electorate.

I think Cicero summed up our current situation well: “Now, there are many — and especially those who are ambitious for eminence and glory — who rob one to enrich another; and they expect to be thought generous towards their friends, if they put them in the way of getting rich, no matter by what means. Such conduct, however, is so remote from moral duty that nothing can be more completely opposed to duty.”

[Reply]

Thank you Michael for another excellent and thought provoking piece.

Your “Charting The Path to Tyranny” is the single most important piece of evidence I use to demonstrate to colleagues, peers and constitutents he folly of Big Governments and Big Government Deficits. Your Chart is invaluable to challenge my fellow citizens to wonder why we think (without thinking) that 50% and even higher marginal tax rates and layers and layers of regulatory requirements are ‘normal’ when no genuinely free peoples (eg as recent as 3 generations ago) have ever paid more than 10% marginal or total annual taxes or tributes to their political masters.

I am looking forward to reading your “Angry Mobs and Founding Fathers” – Amazon can’t deliver it to me in Australia fast enough for my liking.

In my view it is not a proper role for a Government to manage an economy. But woe [A Hell of spiralling Keynesian dimensions] awaits any economy that does not manage its Government.

I can’t help but wonder how strong and free the American peoples (the Australian peoples, etc etc) would be if, every year for the past 100 years their Governments had been constrained from temptations and had run balanced plus 1% budgets – ie total Govt Expenditure for period = 99% of the total tax revenue for the period. (G = 0.99 x T)

I also can’t help but wonder how strong the people would be if for the past 100 years no private purse was hit with taxes of more than 10% of its contents. [The 10% is arbitrary value judgement. I think the 2% of 1770s a little too skinny. I realise more progressive thinkers might think a % bigger or double or more than 10% is ‘best. My thought is that those other moneys would be best left in individual and family hands to voluntarily fund charity and welfare and other profiit and non-profit projects free of Govt confiscation and dictation. But the ‘best’ % is a different set of issues to the general marginally positive budget balances principle itself.]

Imagine how much stronger and freer the people, as individuals, families and as communities (eg church, secular, educational and cultural) would be if Governments operated within two such constitutional limits and respected (ie without aggressive regulation, destruction and absorption of) the turfs of those other important pillars and institutions of society.

I can’t help but thinking that Governments should never under any circumstances be allowed to borrow or meddle in monetary or other financial markets on any sort of market-making stealth-creeping, Keynesian scales. The unspoken pillars of Keynesian faith – that the production of government goods and services should be multiplied, and or somehow become more valued by citizens, or more efficiently provided by central planning Government processes, whenever the economy values fewer private goods and services — this seems pretty warped thinking to me.

Worse, just as fractional reserve banking carries risks for the monetary system – how much is that risk magnified by Governments of Keynesian creed who firstly ramp up spending, secondly ramping up taxes and thirdly borrowings, all with Keynesian-stealth over years and decades, to the extent that eventually each years’ tax crop is barely enough to cover the interest coupons on all of that accumulated and growing mountain of Government debt assets.

I have seen suggestions that accelerating Keynesian economics is like playing “Russian” roulette with a whole economy of peoples – a giant Ponzi scheme. Perhaps those suggestions carry more ‘Founding Father’ truth and logic than any remaining blind Keynesian apostles would care to admit.

It is not too late to start the balancedbudget +1% approach to funding essential government goods and services. Now we have recognised, I hope, and not before time, that the Keynesian darling Public Debt ” Greed is Good” message is equally bad (even badder) for Capital Hills than it is for Wall Streets.

I wonder how many years, how many generations of carefully, slowly and safely, shrinking before reversing our rates of growth of tax cropping, whilst slowing shrinking before reversing our rates of growth Government sectors spendings, are ahead of us. I say we must turn around and must hasten slowly lest we kill the already weakened patients before our countries can get back to a representative clean sheet, where a genuine 100 years of balance budgets +1 % can begin in earnest (and the willpower and constitutional checks and balances and institutions required can be learned and created).

Even with the current US Govt debt mountain and the debt-limit talks between POTUS and the Senate looking grim, the USA remains so much better placed than Australia (Constitutionally, politically, culturally and economically) to lead the way in showing the Western Nations how to get out of these Frankenstein Government debt situations.

James Johnson CHR

B.Ec (Hons) / LL.B

Independent Federal Candidate for Lalor

(Candidate for the Australian House of Representatives)

Constitutional Human Rights Advocate

Solicitor and Barrister of the High Court of Australia

[Reply]

An excellent article, Michael, well-argued and superbly presented.

[Reply]

I came across your fine article while drafting the “A FEW MONEY MATTERS†panel of the granite “History of the United States of America†Rough DRAFT FYI

By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.

The process engages .. economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose. JOHN MAYNARD KEYNES

INFLATION IN THE UNITED STATES

The average worker in 2008 had to work almost twice as long as the average worker in 1950 to buy a loaf of bread .

To buy a new house in 2008 required far more than twice as many hours of work; 11,791 hours of work in 2008 were needed to buy the same new home that the same average person worked only 5,281 hours to buy in 1950 .

THEN AND NOW

$ YEAR 1950 +/- $ YEAR 2012

Hamburger 1lb .30 3.99

Milk 1 Gallon .82 2.50

Gasoline 1 Gallon .18 3.50

Postage Stamp .03 .45

Invention and productivity led to a reduction in cost of some items, notably television sets and computers which unfortunately are inedible.

OUR 2012 DOLLAR is worth less than 5 cents of 1913.(Birth of the Federal Reserve System .)

OUR NATIONAL DEBT

The Revolutionary War crushing debt of…. In our 1789 country of only 3 million + citizens was reimbursed entirely by the Year 1835.

“I believe.. a national debt is ..a curse to a republic.. dangerous to the liberties of the country .“ “You must pay the price if you wish to secure the blessing.†PRESIDENT ANDREW JACKSON 1767-1845

NATIONAL Debt in Year 2012 IS OVER $ 16,000,000,000,000

INCREASING $1,100,000,000,000+ per year

Debt per person : $ 51,700+ .

Added concern : Unfunded government liabilities (Social Security, Medicaid, etc.) are $1,000,000+ per taxpayer.

No pecuniary consideration is more urgent than the regular redemption and discharge of the public debt. ~ George Washington

With reimbursement as critical as in 1789, have we the moral fiber of our ancestors?

[Reply]

We need to dissolve the federal reserve system

[Reply]

Leave a Comment